The Ultimate Guide to Forex Trading Online Platforms 1957390219

The Ultimate Guide to Forex Trading Online Platforms

In today’s digital age, the foreign exchange market, or Forex, has become increasingly accessible to individual traders. With the rise of forex trading online platform Morocco Brokers and other online trading platforms, enthusiasts and professionals alike can engage in currency trading from the comfort of their own homes. This article aims to provide a comprehensive overview of Forex trading online platforms, covering everything from basic concepts to advanced trading strategies.

Understanding Forex Trading

Forex trading involves the exchange of one currency for another in a decentralized global market. The Forex market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion. This liquidity allows traders to enter and exit positions with relative ease, making Forex trading an attractive opportunity for many.

The Basics of Forex Currency Pairs

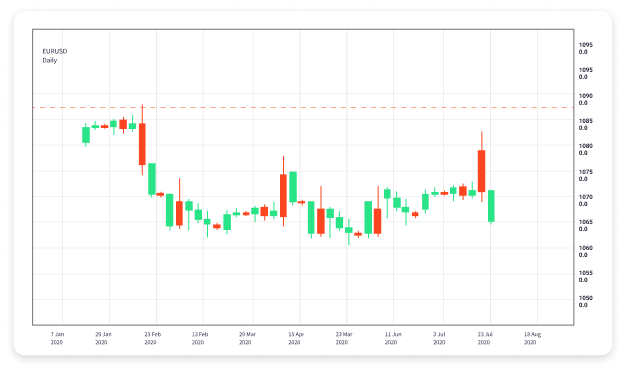

In Forex trading, currencies are traded in pairs. Each pair consists of a base currency and a quote currency. For example, in the currency pair EUR/USD, the euro is the base currency, while the U.S. dollar is the quote currency. The exchange rate indicates how much of the quote currency you need to purchase one unit of the base currency.

The Importance of Online Trading Platforms

Online trading platforms play a crucial role in the Forex trading experience. They provide traders with the tools and resources necessary to conduct analysis, make trades, and manage their portfolios. Here are some key features to look for in a Forex trading platform:

1. User-Friendly Interface

A user-friendly interface is essential for both novice and experienced traders. A well-designed platform allows users to navigate easily between different features and can help facilitate faster trading and analysis.

2. Robust Charting Tools

Effective trading often relies on solid technical analysis. Look for platforms that offer advanced charting tools, including various indicators and drawing tools that can help visualize market trends and price movements.

3. Access to Educational Resources

The most successful traders continuously grow their knowledge. Online platforms should offer educational content, including webinars, articles, and tutorials to help users improve their trading skills.

4. Customer Support

Reliable customer support is crucial, especially for new traders. Ensure that the platform you choose provides various support options, including live chat, email, and phone support.

Choosing the Right Broker

The broker you choose significantly impacts your trading experience. Here are some factors to consider when selecting a Forex broker:

1. Regulation and Licensing

Always choose a regulated broker to ensure your funds are safe. Check if the broker is licensed by a recognized financial authority and operates under strict regulations.

2. Trading Fees and Commissions

Different brokers have different fee structures. Look for transparent information regarding spreads, commissions, and any other fees associated with trading. It’s essential to choose a broker that offers competitive rates, as high fees can eat into your profits.

3. Withdrawal and Deposit Options

Choose a broker that provides a variety of deposit and withdrawal methods, including bank transfers, credit cards, and e-wallets. Ensure that the withdrawal process is straightforward and quick.

4. Trading Platforms and Tools

Your broker’s trading platform is your gateway to the Forex market. Ensure that it is stable, intuitive, and provides all the necessary tools for analysis and trading.

Market Analysis Techniques

Effective trading requires a sound understanding of market analysis techniques. The two primary methods of analysis are:

1. Fundamental Analysis

Fundamental analysis involves evaluating economic indicators, interest rates, and geopolitical factors to predict currency movements. Traders should stay informed about economic news releases and major events that can impact currency values.

2. Technical Analysis

Technical analysis focuses on historical price movements and patterns. Traders use various tools and indicators to identify trends, support and resistance levels, and potential reversal points in the market.

Emotional Management and Trading Psychology

Forex trading can be emotionally taxing, and managing your emotions is critical for success. Here are some tips to enhance your trading psychology:

1. Develop a Trading Plan

Create a comprehensive trading plan that defines your goals, risk tolerance, and trading strategies. Stick to your plan and avoid impulsive trading decisions based on emotions.

2. Use Risk Management Strategies

Implementing proper risk management techniques is vital. Consider setting stop-loss orders and never risking more than a small percentage of your trading capital on a single trade.

3. Keep a Journal

Maintaining a trading journal can help you track your performance and identify patterns in your trading behavior. Analyze your successes and failures to improve your future performance.

Conclusion

Forex trading on online platforms has made it easier than ever for individuals to participate in the foreign exchange market. By understanding the basics of Forex trading, choosing the right broker, and implementing effective trading strategies, anyone can become a successful trader. Remember to continually educate yourself, practice disciplined trading, and manage your emotions throughout your trading journey. With determination and persistence, you can navigate the world of Forex trading and achieve your financial goals.